How to avoid fraud - FAQs

Topics

- Auto/Toy Loans

- Business

- Checking/Savings

- Community

- Credit

- FAQs/Resources

- Fraud/Security

- Home Loans

- Investing

- Money Talk

- Money Tips

- Numerica News

- Recent Stories

Seems like every time we turn on the news, it’s something about fraud, identity theft, or a data breach. You can avoid being a victim of fraud by being aware of common fraud tactics.

Learn about spotting signs of fraud and understanding types of fraud. Understand the steps and process to take if fraud has occurred on your account. Numerica is here to help you prevent fraud and identity theft.

Learn:

- The signs of fraud

- Examples of fraud

- Steps to take

- How to protect yourself

What are signs of fraud on an account?

When most people think of fraud, they envision withdrawals from their account. But fraud often occurs when funds are received. Receiving unexpected deposits or being overpaid with a check and asked to send money back, is a red flag.

This type of fraud takes advantage of the lifecycle of a check.

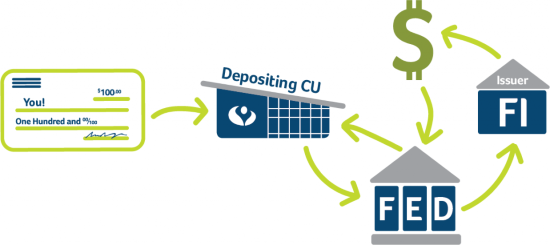

Once you deposit your check, the cash value may appear in your account. However, it may have a hold on a certain portion or all of the check. This hold is a good faith gesture that the money is there. The hold lasts up to 7 days.

Just because the hold on a check may be released, does not mean the funds have cleared.

The check then goes to the Federal Reserve. They send it to the other person’s financial institution to see if the money is available. The other institution will then pull the money out of that account. If the check is fraudulent, they say, “Nope! No good,” and return the check back to the Federal Reserve.

The Federal Reserve returns the “bounced” check to Numerica. This means funds you thought you had will no longer be there. You may be liable for a returned check fee. This process typically takes anywhere from two days to two weeks.

Receiving an ACH (direct deposit or payment) doesn’t mean you are in the clear either. ACH transactions could be potentially be returned as fraudulent up to 60 days after they’re received. You could owe money if it has been spent.

These, of course, are worst case scenarios. Many checks and ACH deposits that are legitimate occur daily. It’s always best to know the source of the money you receive.

If someone asks you to put money into your account and then give some back, first ask yourself,

“Why am I the middle man?”

A legitimate business wouldn’t ask you to do that. So if it doesn’t make sense or feel right, don’t take that “money.”

Instead of writing checks, consider other payment options like Online Bill Pay. You can also use your debit or credit card to set up recurring payments. It’s a great time to start thinking about writing fewer checks and looking into your other options.

What are common examples of fraud?

Your personal information is constantly being targeted. Identity theft, phishing attempts, spoofed emails, breaches, or scams — this multi-billion dollar industry is always growing and evolving.

Scam attempts are constant. Lottery scams, secret shopper scams, sweetheart scams. There are hundreds. Typically, fraudsters look to gain access to your accounts or use fraudulent checks. By taking advantage of the complexity of how a check works, many people are duped by fraudsters.

What steps does Numerica take if fraud may have occurred?

Numerica is constantly monitoring accounts for fraudulent activity. Besides Fraud Text Alerts, you can enroll in notifications through Online Banking. Any questions on this can be answered by a Numerica team member at 800.433.1837.

If our fraud monitoring detects a suspicious transaction on your account, we will alert you of the transaction. You can confirm if the transaction was authorized or not. The account may also be frozen. If you suspect fraudulent activity, please call us immediately at 800.433.1837.

What should I do if I think fraudulent activity has taken place on my account?

Call Numerica immediately at 800.433.1837 or stop by your closest branch. If you have had your identity stolen, check out what to do if you’re the victim of stolen identity.

What are the best ways to protect my accounts from fraud?

There are several things you can do to make your accounts safer including:

- Being mindful on social media

- Using strong and unique passwords

- Monitoring your credit report

- Keeping an eye on your account

- Practicing digital wariness

- Watch out for skimmers

Social media

Protect your identity when using social media. Now more than ever, most social networks are giving you the power to protect yourself.

If you’re big on keeping your accounts as secure as possible, look into two-factor authentication. You have added protection of security questions or a randomly generated code. That code can be sent to an email, cell phone, or generated via an app.

When it comes to security questions, who says they all have to be true? There are certain times to use real answers and others when making up an answer is your best bet.

When signing up for a financial account or verifying Apple Pay, you may be prompted to enter personal information. If you have any hesitation about the request, reach out to the financial institution or even Apple (in this example).

When is it best to use bogus answers? Think about the process of signing up for Online Banking with Numerica. You were prompted to include two or more security questions. Something like the color of your first car, for example. Rather than admit to it being red, how about using an answer like “caramel macchiato” or “pink glitter and unicorns.”

As long as YOU know the answers, you can toss in some curve balls with false answers. What was your first car — 1967 Cougar? You know it was a matchbox car, but a fraudster would never be able to guess.

Passwords

3 out of 4 consumers use duplicate passwords, many of which have not been changed in 5 years or more. Yikes! If someone guesses your password, they may have access to more than one of your accounts. Remembering passwords is a pain, but having to deal with fraud is no walk in the park. It can take years to recover.

There are secure password apps that save you from having to remember every single password. These apps include random password generators. Passwords are secured in a “vault” that you can access with a master password. For the more security conscious among us, a dual authentication code.

The benefits to using these vaults are the ability to use random characters and strings for passwords, and the ability to change your passwords frequently without fear you will forget them.

Credit report

Keep an eye on your credit report. This is not a set it and forget it process. Watch your report closely.

Your account

Keep an eye on your account. A quick glance every Monday, for example, can help keep you safe. If you notice something weird on your account, give us a call or visit your favorite branch. If it’s after hours, call the number on the back of your card.

Digital wariness

Some of the websites in your social feed or Google search may not be legitimate businesses. Verify websites before shopping.

If your phone has an update, do it. Not installing updates means you miss out on security patches, putting your phone and data at risk.

Skimmers

Skimmers are external devices that fit over legitimate transaction sites like ATMs or gas station pumps. When you swipe your card, it is actually the skimming device that captures your card information. If you select the debit option, the device may also be capturing your PIN. Avoid this by using your card as a credit card or using mobile pay to add a layer of security.

Before you swipe, be wary of anything out of the ordinary. A mismatched keyboard or out of place wires might indicate a skimmer. If something isn’t looking right, let someone know.

There are many ways you can protect yourself from fraud. Simply being aware, paying attention to your account, and changing passwords can keep you out of fraud’s way.

You work hard for your money. Keep it out of the wrong hands.