Money where it matters

Helping you grow, save, and achieve your goals.

Numerica will be closed Friday, July 4, in observance of Independence Day.

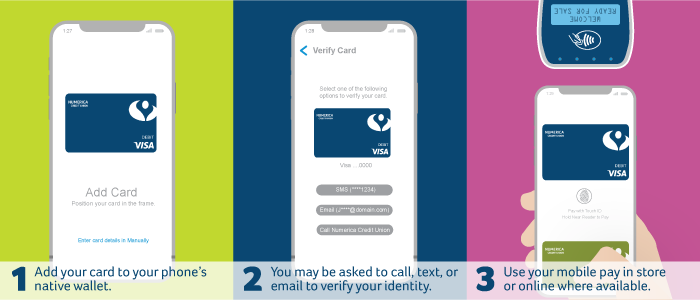

Make secure, convenient payments with your Numerica Visa using Apple Pay, Google Pay, or Samsung Wallet. Learn how to set up contactless payments today!

Sure, the plastic version of your Numerica Visa debit or credit card fits nicely in your wallet, but did you know it can be stored in your phone’s mobile wallet as well? You could even add it to your wrist to pay with devices like an Apple Watch.

This is a form of contactless payment — a convenient, secure method for making purchases using your smartphone or device. No need to swipe or insert a physical card. Instead, pay with your Numerica Visa through Apple Pay, Google Pay, or Samsung Wallet, among others.

Setting up contactless payments using a mobile wallet is quick and easy.

When you’re at a store that accepts contactless payments, hold your device over the payment reader. Whether you’re using the latest smartphone or an enabled accessory like an Apple Watch, there will be an authentication step for added security. Depending on your device and preferences, this could be facial recognition, a fingerprint, or a passcode.

Each transaction uses a one-time, unique virtual validation — not your actual card number. The secure, token-based authentication means your sensitive financial information is not transmitted.

Paying is just a touch away. No more fumbling with your wallet and looking for the right card.

Paying with your mobile wallet means you are touching shared surfaces less (think PIN pads, pens, and card readers). It also means less shared transactions such as exchanging cash.

Many apps and devices integrate with your mobile wallet for secure, convenient transactions.

Google Pay, Samsung Pay, and Apple Pay are only available if you have a smartphone or an associated device, such as Apple Watch, Fitbit, or Garmin.

Some stores may not accept mobile pay yet.

Contactless payments are another great way to live well financially. If you have questions about adding your Numerica Visa to your mobile wallet or using it to make payments, call Numerica Credit Union’s eServices team 800.255.9194 or stop by your favorite branch.